Financing tools are a valuable resource for contractors to take advantage of. And solar financing options have one main goal in mind: to help provide solar contractors the financial means to complete more projects. For a long time the only way to complete a solar project was to buy the system outright. But that is no longer the case. With multiple products on the market and each having a valuable use for different scenarios it’s important to be aligned with a partner who has the knowledge and expertise to provide support on these kinds of questions. That’s where Greentech Renewables comes in. In this introduction to commercial finance we will go over some of the most common commercial financing products contractors can take advantage of, and some of the differences between commercial and residential financing.

Differences between commercial financing and residential

It’s very important to highlight the differences between commercial and residential financing, these include both the size of the financing needs and the complexity of the projects. Commercial projects are typically more complex than residential projects because they involve a greater number of stakeholders involved. In residential there's typically only a few parties involved: the installer, the property owner and then maybe an additional end-user. For commercial projects that number usually increases. With more stakeholders, more planning is involved and more points of view must be taken into consideration. For most commercial projects, the size of a project is 75 kW or greater. For residential projects the project size is, on average, 7 kW. This increase in size for commercial projects also leads to a greater dollar value for commercial projects compared to residential projects.

A key part of commercial finance are the many different products that are now available to contractors. So next we will provide overviews of the products and layout some of the details about each one. Over the coming months we will provide an in-depth article of each of these products, those links can be found in this article once they’ve been posted. DISCLAIMER: This guide provides an overview for those interested in commercial solar. THIS GUIDE IS NOT INTENDED AS AND DOES NOT CONSTITUTE PROFESSIONAL TAX ADVICE OR OTHER PROFESSIONAL FINANCIAL GUIDANCE. This guide should not be used as the only source of information when making purchasing decisions, investment decisions, or tax decisions, or when executing other binding agreements. Always consult with an attorney or licensed financial advisor for professional tax and investment guidance.

Solar Loan

Similar to most loans, a solar loan allows for an installer to pay monthly payments instead of the entire cost of the solar project all at once. The cost of this monthly payment schedule is that installers will also have to pay the provider of the loan interest and the amount of interest you have to pay can vary quite a bit. Some of the considerations that determine the interest rate are the term length of the loan, the solar installation company’s credit standing, and how many years the business has been installing solar. Again, these are only some of the relevant criteria.

There are also quite a few benefits to using a solar loan. First, it has minimal upfront costs and reduces your capital investment. With less money being tied up into the costs of equipment, contractors can spend their resources on other areas of need to help their business grow. Solar loans also provide access to the ITC (Investment Tax Credit) and other financial benefits of ownership. Additionally, solar panels are assets that create a good deal of financial value, maintaining ownership of that value can be a smart decision for the holder of the solar loan. Solar loans are offered at multiple institutions like traditional banks, solar panel manufacturing companies, national lending institutions, public-private partnerships, and municipalities.

Solar Lease

A solar lease allows for contractors to lease solar equipment for no upfront cost for an individual project. Its specific purpose is to allow for the generation of electricity with little to sometimes no capital investment. The lessor provides the lessee a monthly lease payment for the equipment used, in return, the lessor will see a decrease in their monthly electric bills over time. After the first five to seven years of the lease agreement the lessor has the ability to either extend & continue the lease, purchase the solar system (at a reduced cost), or return the equipment to the lessee.

The benefits of a solar lease are numerous. Similar to solar loans a solar lease provides minimal capital investment and can free up funds for other needed business operations. A huge benefit is that the lease provides protection from changing electric prices & provides savings on electricity bills. The main benefit of the lease is the savings businesses will see on their electric bill. This savings can offset the lease payments providing value to the lessee. A final benefit is that leasing often provides lower cost financing than a loan or PPA agreement.

Solar PPA

Next we have a Solar PPA or Power Purchase Agreement. A PPA is an agreement that allows businesses or governments to purchase solar from a “host” organization. The “host” organization provides a large amount of unused land; such as rooftops, or an open field to a provider of solar power. The solar provider is then responsible for the installation, maintenance, ownership, and operation of the solar system. A PPA contract will typically last 15 to 20 years and then the host organization will have the option to purchase the system, negotiate another PPA, or have the solar system removed.

One of the benefits of a PPA is that it provides the lowest capital investment out of all these tools, in fact it requires no capital investment by the host organization! Another advantage of PPA’s is that they are performance based, so the organizations only have to pay for the energy produced, and they have no responsibility for the operations and maintenance of the system. Because of these advantages to buyers most PPA providers are typically only conducted by experienced solar professionals.

C-PACE

Another resource available is C-Pace. Available in 36 states, the Commercial Property Assessed Clean Energy program provides a benefit to building owners and developers who make energy maintenance upgrades to their buildings. The program allows for property upgrades to be financed with minimal money down and covers the useful life of the project. Renewable energy projects, such as solar projects, are eligible for this program.

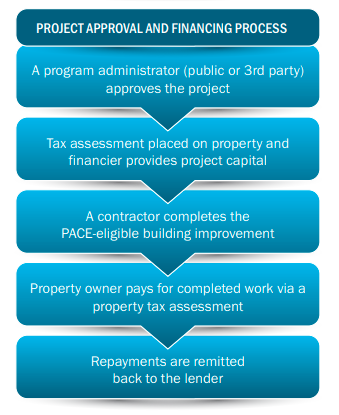

Commercial Property Assessed Clean Energy (C-PACE) is affordable financing that allows commercial property owners to pay for upgrades that increase energy efficiency, harness renewable energy, conserve water, and protect against storms. What makes C-Pace different from the other products we have mentioned is that the financing is repaid through a tax assessment of the commercial property. Once the new project has been completed and the value of the property has risen the owner’s payment is based on a property tax assessment. This means that the projects can have long term financing, 20-30 years, and C-Pace tax assessment can still be completed even if ownership of the commercial property changes hands. The graph below has a nice walkthrough of what the C-Pace process is like.

(image from energy.gov)

Comments

have a commercial solar finance person contact me at 6364483454