You may have recently noticed that it's been harder to find your preferred modules. Or, that prices have increased relative to what they were a few months ago. Well, you're not wrong. The module market for 2019 will be a tricky one. This article will go over some of the reasons why, as well as provide key takeaways so that you can plan efficiently for your upcoming projects.

Increased Demand

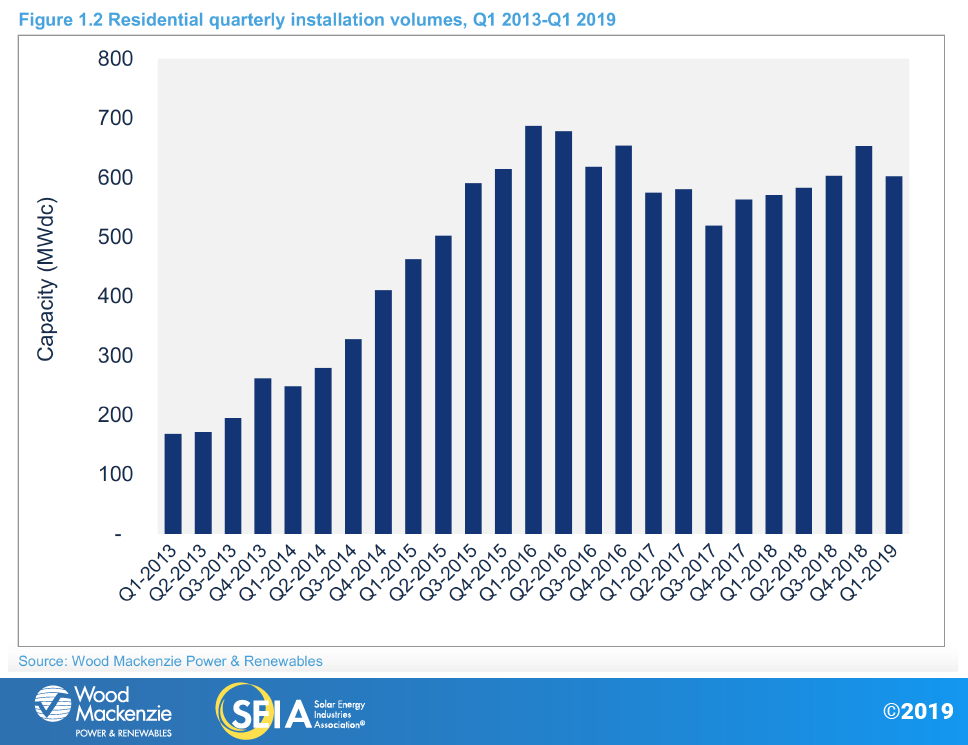

Much of the reason why rooftop solar is attractive for homeowners and businesses is because of the 30% Investment Tax Credit (ITC). The financial benefits of this tax credit have allowed our industry to grow dramatically, reducing the payback period for system owners. However, 2019 is the last year where the ITC will be 30%, and as a result, demand is rising rapidly for projects to be completed with the full credit.

(As a side note, it is possible to safe harbor the 30% ITC by commencing construction with continuous progress or by investing 5% of the total project’s budget by 12/31/2019.)

Decreased Supply

In June of last year, the Chinese government removed subsidies that had been largely responsible for the country's exponential growth in solar deployed. This led to roughly 20 GW of canceled projects and a supply glut of product, mostly modules, that made its way into the US market. Despite the Section 201 tariffs, it was still possible to find well-priced modules in the second half of 2018 as Chinese manufacturers were desperate to sell their excess products. Unfortunately, most of that supply is no longer available.

In addition, after the tariffs were announced, many module manufacturers decided to open US manufacturing facilities as a way to remain competitive. However, some of those facilities are still being constructed or are running at a restricted capacity, further straining the market’s incoming supply.

Polycrystalline to Monocrystalline

The module industry is moving towards more efficient, aesthetically pleasing and newer technology products. For most manufacturers, this means transitioning from polycrystalline to monocrystalline cells, the latter being more expensive to produce. Many Tier-1 manufacturers have already stopped accepting purchase orders for polycrystalline modules to the US, and it is only a short matter of time before Mono PERC becomes the industry standard. Some manufacturers are even shifting towards more innovative technologies, such as shingled cells or bifacial modules, which are more costly.

Key Takeaways

Given the current landscape for solar modules in the US, you can expect prices to go up by a few cents and for availability to be limited on most modules, especially lower-priced 72-cell panels, throughout the rest of the year. If you need help planning ahead for upcoming projects to ensure your products are available when you need them and at the right price, contact your dedicated Greentech Renewables Account Manager today.